India's real estate sector is poised to reach a milestone of USD 1 trillion by 2030. The market is measured as cautiously optimistic in Q3 2025 with structural stability, policy reform, and shifting buyer sentiment.

While transaction volumes were marginally moderated, fundamentals of the Indian residential real estate remained robust as domestic demand was strong, the sector digitized, and government policies (such as RERA, GST, and Digital India) were implemented.

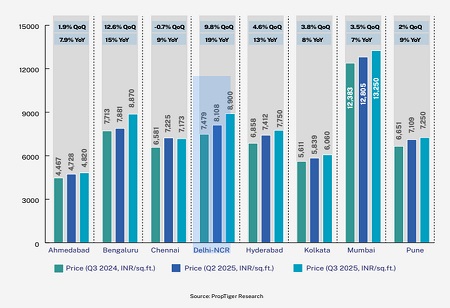

Prices & Inventory Trends

Residential prices across top cities rose sharply, led by the Delhi NCR, Bengaluru, and Hyderabad. Supported by a shift toward luxury, national weighted average prices increased simultaneously.

Residential prices across top cities rose sharply, led by the Delhi NCR, Bengaluru, and Hyderabad. Supported by a shift toward luxury, national weighted average prices increased simultaneously.

The continued appreciation and ongoing healthy inventory cycle demonstrate a mature, value-driven market.

Despite a marginal decline in unit volumes, the total sales value rose 14 % year-on-year in Q3 2025 — clearly signaling that premium and luxury homes are spearheading the growth. - PropTiger

Q4 2025 Outlook: Cautious Optimism Ahead

The last quarter of 2025 is shaping up to be a robust activity, driven by demand for the festive season and stable financing conditions. We expect that developers will announce new housing projects, bundled with attractive schemes, aimed at capturing buyers at year-end.

The silver linings come from the good-news stories of the GST cuts, which will bolster opportunity in the market; a steady home loan rate; and end-user demand, which remains resilient.

There are still challenges in the affordable segment, where rising prices have created budget strains to housing income, and in the luxury category,y where the absorption of inventory in the upcoming period will be critical to maintaining momentum.

Despite global economic uncertainties and geopolitical tensions, residential demand in India remained reasonably resilient, supported by rising incomes, urbanisation, and aspirational homeownership sentiment. — Anuj Puri, Chairman, ANAROCK Group

Overall, India’s residential real estate market remains structurally strong, with policy support, investor confidence, and economic fundamentals coming together to support continued solid growth into 2026. The evolution to digital transparency, premium housing, and sustainable urban infrastructure represents the future of Indian property we expect to see in the next chapter.

We use cookies to ensure you get the best experience on our website. Read more...

Copyright © 2025 HomesIndiaMagazine. All Rights Reserved.