India's real estate sector is poised to reach a milestone of USD 1 trillion by 2030. The market is measured as cautiously optimistic in Q3 2025 with structural stability, policy reform, and shifting buyer sentiment.

While transaction volumes were marginally moderated, fundamentals of the Indian residential real estate remained robust as domestic demand was strong, the sector digitized, and government policies (such as RERA, GST, and Digital India) were implemented.

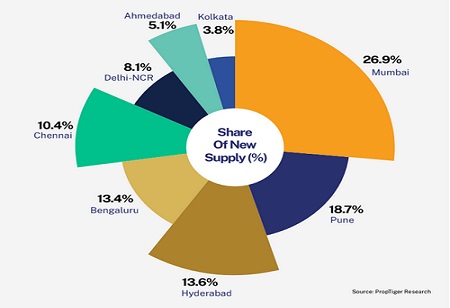

Which cities led India housing sales in Q3 2025

City-Wise Performance Overview

Property investors must adopt location-specific strategies more than ever before. Those looking for long-term real estate investments can target markets with high appreciation, while rental-focused investors should focus on localities where rents are rising steadily. - Dr. Prashant Thakur, Executive Director & Head – Research & Advisory, ANAROCK Group

Ahmedabad: In the third quarter, total sales were pegged at 8,889 housing units, reflecting a decline of 5.9 per cent quarter-on-quarter (QoQ), in the context of subdued demand in the mid-segment. Infrastructure improvements, such as the widening of the Sardar Patel Ring Road and the extension of the metro project, bolstered long-term expectations.

Bengaluru: Total sales were pegged at 13,124 units, led by IT-driven end-user demand. Prices were strong, with a 15 percent year-on-year (YoY) appreciation, supported by the metro project and plotted development activity.

Chennai: One of the fastest-growing markets, Chennai recorded an increase of 120.8 per cent YoY for sales and 105 per cent YoY for new supply. Given ongoing infrastructure developments, Chennai will continue to provide remaining developers with an upbeat outlook.

Chennai has emerged as one of the country’s most resilient residential markets, driven by job creation from global capability centres and a steady supply of quality projects - Sanjay Chugh, City Head & Director – Chennai, ANAROCK Group.

Delhi NCR: Delhi NCR exhibited YOY declines of 20 per cent in terms of both supply and sales, but recorded the most substantial price appreciation: 19 per cent YoY. Demand for luxury housing was strong, particularly in the Gurugram region.

Delhi NCR: Delhi NCR exhibited YOY declines of 20 per cent in terms of both supply and sales, but recorded the most substantial price appreciation: 19 per cent YoY. Demand for luxury housing was strong, particularly in the Gurugram region.

Hyderabad: The leading performer, with total sales of 17,658 units sold (+52.7 per cent YoY), the market benefited from growth in IT, and the ongoing improvements in physical infrastructure (e.g., Regional Ring Road and metro) will be beneficial going forward.

Kolkata: Received an increase of 128.8 per cent YoY for new supply, reflecting a sustained and strong recovery. Festive sentiment will assist the momentum for mid-segment and premium-segment sales in the market.

Mumbai Metropolitan Region (MMR): Despite a 10 percent QoQ decline in sales, property prices continued to rise steadily with launches of luxury stock by Lodha and Raymond Realty, aided by infrastructure improvements from MTHL.

Mumbai’s residential market remains driven by end-users seeking premium living spaces. The 7 % year-on-year rise in prices reflects strong demand and limited supply elasticity. — Gulam Zia, Senior Executive Director, Research, Advisory, Infrastructure & Valuation, Knight Frank India

Pune: New supply rose by 26 percent QoQ to 17,163 units, while sales fell by 18.6 percent. Prices have increased by 7 percent YoY, which is pressurizing affordability, but strong fundamentals remain due to growth in IT and manufacturing.

We use cookies to ensure you get the best experience on our website. Read more...

Copyright © 2025 HomesIndiaMagazine. All Rights Reserved.