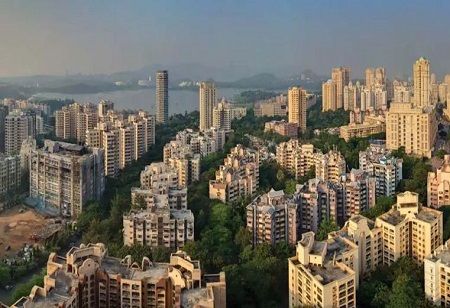

The Indian real estate sector is witnessing a notable transformation due to the increase in Tier 2 cities property appreciation. According to a recent report made by Magicbricks, the average capital appreciation in Tier 2 cities has shot up to 17.6 percent, which is higher than Delhi’s 15.7 percent and the national average of 11.1 percent. This sudden change has made real estate in Tier 2 cities a go-to option for investors and property purchasers, where a return on investment is yielded.

Inclusive Development

The tier 2 cities of India promote inclusivity. MSMEs, local vendors, MNCs, retirees and new land owners all can invest in this semi-urban region and gain profit, without limiting themselves to one particular area.

Better infrastructure

The infrastructure facilities in the tier 2 cities are more secure compared to other cities. Due to the government’s interest in development, increased connectivity, and employment facilitation makes the properties of the tier 2 cities are more convenient for investment over the metro cities.

The emergence of tier 2 cities has made the investment easier and more secure for the investors. A few of the cities like Ahmedabad, Vadodara, Surat, Vishakapatanam, Nashik, Gandhinagar, Jaipur, and Nagpur are a few of the top tier 2 cities for property investment. It is safe to say that these cities are the emerging real estate markets in India, due to assured security and return on investment. If you are planning to invest in properties, then tier 2 cities are the best assets to invest in.

Boman Irani, President, CREDAI, said, “India’s real estate sector is undergoing a paradigm shift, with tier II and III cities playing a central role in urban expansion. As these cities become economic and industrial hubs, there is an increasing demand for affordable and mid-segment housing. Developers are recognizing this shift, leading to a surge in investments and new projects.”

Frequently asked FAQ’s Why are Tier 2 cities outperforming metros in property appreciation?

Tier 2 cities like Indore, Lucknow, and Coimbatore are witnessing rapid growth due to affordable property prices, better quality of life, and rising infrastructure investment. With capital appreciation touching 17.6 percent, these cities offer higher ROI than many metro counterparts, drawing both investors and end-users alike.

What makes Tier 2 cities attractive for real estate investment in 2025?

Lower entry costs, larger land parcels, improved connectivity, and government-backed urbanization schemes make Tier 2 cities ideal investment zones. Their blend of affordability and growth potential ensures better long-term gains, especially as demand for housing rises outside metro clusters.

How are infrastructure and government policies boosting Tier 2 real estate?

Initiatives like Smart Cities Mission, AMRUT, and improved highways and metro connectivity are transforming Tier 2 cities into modern urban hubs. Tax incentives, ease of approvals, and support for startups are also catalyzing corporate presence, job creation, and housing demand.

We use cookies to ensure you get the best experience on our website. Read more...

Copyright © 2025 HomesIndiaMagazine. All Rights Reserved.